Answer:

Correct answer to this question is none of them. But if you reduce the time period to 2 years the answer would be:

C) 5%.

Explanation:

First of all, let me explain that, when project goes profitable and when it is considered non-profitable or at loss.

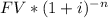

The basic indicator is through PV or Present Value of yield calculation. So, here is the formula to calculate Present Value or PV:

PV =

where,

FV = Future Value

i = annual interest rate

n = period

So, if this PV of yield is greater than initial money that have been invested than project is predicted to be profitable. Let's calculate for all options.

At option a) i = 7% = 0.07

PV= 167,000*

PV = 136321.7454

At option b) i = 6% = 0.06

PV= 167,000*

PV = 140216. 4203

At option c) i = 5% = 0.05

PV= 167,000*

PV = 144260.879

At option d) i = 4% = 0.04

PV= 167,000*

PV = 148462.3919

Here, you can clearly see that, for three years time period, all of the options are incorrect as none of the interest rate gives the PV value greater than initial investment which is 150,000 dollars hence, at 3 years time period project will be at loss for all these options.

But if you reduce the time period to 2 your correct answer would be C) 5%.

the PV is higher at 5% and 4% the highest interest rate at the project is profitable is 5%