Answer:

$9.687

Step-by-step explanation:

Given:

Year 3 dividend = $1.00

Year4&5 growth rate = 17%

Constant rate = 7%

Required return rate = 16%

Year 4 dividend wil be:

D4 = 1.00 * 1+growth rate

= 1.00 * (1+0.17)

= $1.17

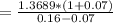

Year 5 dividend=

D5 = $1.17 * (1+0.17)

= $1.3689

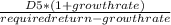

Value of stock after year 5 will be given as:

= $16.2747

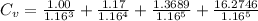

For the current value of stock, we have:

Cv= Fd* Pv of discounting factor

Where Cv = current value of stock

Fd = future dividend

Pv = Present value of discounting factor

Therefore,

=$9.6871382455

≈ $9.687

The value of stock today =

$9.687