Answer:

$120

Explanation:

Let the initial value of bond be $X

The future value of any bond is calculated by formula

FV= PV(1+r)^n

where

- FV is future value of bond

- PV is present value of bond

- r is the rate that at which value of bond appreciate

- n is the number of years of maturity

In the problem given

FV= $146

r = 4% = 0.04 (dividing 4 by 100 we get 0.04)

n = 5

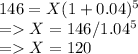

substituting these value in formula

PV =$X = $120

Hence current value of bond is $120.