Answer:

Step-by-step explanation:

The time (T) = 6 months = 6/12 years = 0.5 years

Interest rate (r) = 6% = 0.06

The stock is priced [S(0)] = $36.50

The price the stock sells at 6 months (

) = $3.20

) = $3.20

European call (K) = $35

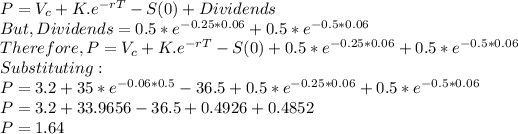

The price (P) is given by:

The price of a 6-month, $35.00 strike put option is $1.65