Answer:

The answer is $343,934.91 (to the nearest cent.)

Step-by-step explanation:

For the second option, we will calculate the future value of an amount invested for a period of time, which is compounded periodically, using the formula:

where:

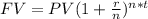

FV = future value = ?????

PV = present value = $10,000

r = interest rate in decimal = 9.6% = 9.6/100 = 0.096

n = frequency of compounding in a year = monthly = 12

t = time = 18 years to 55 years = 55 - 18 = 37 years, \

Therefore:

∴ FV = $343,934.91 (to the nearest cent.)

Note that rounding off to the nearest cent means rouding off to the nearest hundredth or to two decimal places.

Therefore under the second plan, at age 55, he will be given $343,934.91.

Also, if we are asked to compare both options to choose which is better,

for option 1 which will pay him $15,000 for each year of service (that is from 18 years to 55 years):

Years of service = 37 years

lump sum per year = $15,000

Therefore total amount from option 1 = 15,000 × 37 = $555,000

Therefore, at age 55, option 1 is better than option 2.