Answer:

Net Present Value $ 23,373.49

Step-by-step explanation:

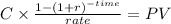

First, we solve for the expected return:

![\left[\begin{array}{cccc}State&Return&Probability&Weight\\best-case&19,000&0.25&4,750\\base-case&12,000&0.5&6,000\\worst-case&-3,000&0.25&-750\\Total&&1&10,000\\\end{array}\right]](https://img.qammunity.org/2021/formulas/business/college/fyqomba1sy7dzc2gu5f6e8dqnj17x8wmo9.png)

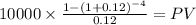

Now, we solve for the present value of this vaue over the four-year period:

C 10,000.00

time 4

rate 0.12

PV $30,373.4935

Last we subtract the investment cosT:

30,373.49 - 7,000 = 23,373.49