Answer:

Net present value

Step-by-step explanation:

Missing Information

Weighted average cost of capital: 8% and Solve for net present value:

investment: project outlay 20,500,000 + increase in working capital 450,000

F10 salvage value: 300,000 + 450,000 liberate working capital

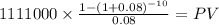

cahsflow per year income 1,111,000

C 1,111,000.00

time 10

rate 0.08

PV $7,454,900.4342

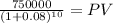

Maturity $750,000.00

time 10.00

rate 0.08000

PV 347,395.1161

Net present value

7,454,900 + 347,395 - 20,500,000 - 450,000 = -13.147.705