Answer:

WACC 13.85600%

Step-by-step explanation:

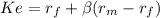

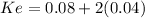

First we calculate Eastern Pizza CAPM:

risk free = 0.08

market rate = 0.12

premium market = (market rate - risk free) 0.04

beta(non diversifiable risk) = 2

Ke 0.16000

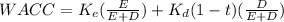

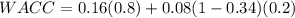

Then we solve for WACC

Ke 0.16000

Equity weight 0.8

Kd 0.08

Debt Weight 0.2

t 0.34

WACC 13.85600%

The company will use the data on eastern Pizza to evualuate project presented to it. Also, it will consider the new tax rate to determinate the tax shield.