Answer:

$1,500; 15%

8.49%; $849

Step-by-step explanation:

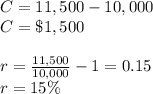

Her original capital gain, excluding inflation is:

Donna's capital gain, for tax purposes is $1,500, which is a 15% gain on her investment.

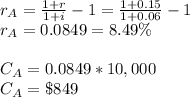

Let 'i' be the rate of inflation of 6%. The adjusted capital gain is given by:

Donna's real capital gain is 8.49%, or $849.