Answer:

YTM: 2.64%

YTC: 3.66%

Step-by-step explanation:

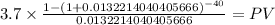

The market price is the discounted price of the maturity and coupon payment at market rate:

C 3.700

time 40

rate 0.013221404

PV $114.3676

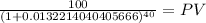

Maturity 100.00

time 40.00

rate 0.013221404

PV 59.13

PV c $114.3676

PV m $59.1324

Total $173.5000

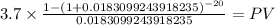

Then we do the same calcaulation with the 161 call price being the maturity and adjusting time for 10 years (20 payment)

C 3.700

time 20

rate 0.018309924

PV $61.4988

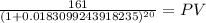

Maturity 161.00

time 20.00

rate 0.018309924

PV 112.00

PV c $61.4988

PV m $112.0021

Total $173.5009

Now we got the semiannual rate we simply multiply by two to convert into annual rates.

YTM:

0.013221404 X 2 = 0,026442808 = 2.64%

YTC:

0.0183099243918235 X 2 = 0,036619848783647 = 0.0366 = 3.66%