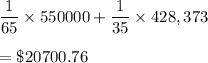

Answer: The expectation for the drilling company is $20700.76.

No, the company should not sink the test well as the cost for sinking is $65000 and our expectation is just $20700.76.

Explanation:

Since we have given that

Probability of hitting oil =

Probability of hitting oil =

Income for the drilling company = $550,000

Income for the natural gas = $428,373

According to question, we get that

Expected for the drilling company would be :

No, the company should not sink the test well as the cost for sinking is $65000 and our expectation is just $20700.76.