Answer:

a)

Cost of debt (after tax) = 5.4%

Cost of preferred stock (

) = 10.53%

) = 10.53%

Cost of common stock (

) = 16.18%

) = 16.18%

b)

WACC = 14%

c)

project 1 and project 2

Step-by-step explanation:

Given that:

Debt rate (

) = 9% = 0.09

) = 9% = 0.09

Tax rate (T) = 40% = 0.4

Dividend per share (

) = $6

) = $6

Price per share (

) = $57

) = $57

Common stock price (

)= $39

)= $39

Expected dividend (

) = $4.75

) = $4.75

Growth rate (g) = 4% = 0.04

The target capital structure consists of 75% common stock (

), 15% debt (

), 15% debt (

), and 10% preferred stock (

), and 10% preferred stock (

)

)

a)

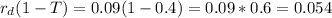

Cost of debt (after tax) =`

Cost of debt (after tax) = 5.4%

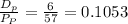

Cost of preferred stock (

) =

) =

= 10.53%

= 10.53%

= 10.53%

= 10.53%

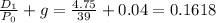

Cost of common stock (

) =

) =

= 16.18%

= 16.18%

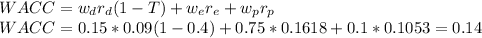

b)

WACC = 14%

c) Only projects with expected returns that exceed WACC will be accepted. Therefore only project 1 and project 2 would be accepted