Check the file attached below for the complete question

Answer:

Step-by-step explanation:

Expected return on the portfolio = (Risk free rate) + Beta of portfolio 1 * (expected return on portfolio 1 - Risk free rate) + Beta of portfolio 2 * (expected return on portfolio 2 - Risk free rate)

35% = 5% + 1.7 * (Risk premium for portfolio 1) + 2.2 * (Risk premium for portfolio 2).................(1)

8% = 5% + 2.1 * (Risk premium for portfolio 1 - 0.8) * (Risk premium for portfolio 2).................(2)

Multiply eq. by 2.75 and add in eqn. 1

35% + 22% = 5% + 2.75 * 5% + 1.7 * Risk premium for portfolio 1 + 5.775 * (Risk premium for portfolio 1) + 0

57% = 18.75% + 7.475 * (Risk premium for portfolio 1 )

Risk premium for portfolio 1 = 5.12%

Put value of( risk premium for portfolio 1 ) in equation 1

35% = 5% + 1.7 * 5.12% + 2.2 * (Risk premium for portfolio 2 )

35% = 13.70% + 2.2 * (Risk premium for portfolio 2 )

Risk premium for portfolio 2 = (21.30%) / 2.2

Risk premium for portfolio 2 = 9.68%

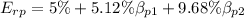

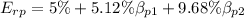

Expected return–beta relationship E(rp) = 5% + 5.12% * (Beta of Portfolio 1) + 9.68% * (Beta of Portfolio 2)