Answer:

Step-by-step explanation:

A minimum variance portfolio is a portfolio that consists of individually assets which are risky, hedged when traded together, thereby producing the lowest possible risk for the rate of expected return. It reduces the risk of assets by hedging and trading them together.

Given that for stock D:

expected return(

) = 19% = 0.19 and a standard deviation (

) = 19% = 0.19 and a standard deviation (

)= 35% = 0.35

)= 35% = 0.35

For stock I

expected return (

) = 10% = 0.10 and a standard deviation (

) = 10% = 0.10 and a standard deviation (

) = 15% = 0.15

) = 15% = 0.15

Correlation = -0.04

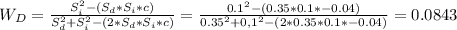

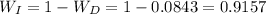

The weight of stock D (

) is given as:

) is given as: