Answer:

Faulk: -0,1925629 = -19.25%

Yoo: 0,1615398 = 16.15%

Step-by-step explanation:

We need to solve forthe present value of the coupon and maturity on each bond considering the yield to maturity of 7% and 9% and compare the price variations:

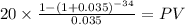

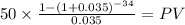

C 20.000

time 34

rate 0.035

PV $394.0137

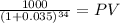

Maturity 1,000.00

time 34.00

rate 0.035

PV 310.48

PV c $394.0137

PV m $310.4761

Total $704.4897

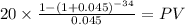

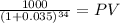

C 20.000

time 34

rate 0.045

PV $344.9352

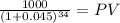

Maturity 1,000.00

time 34.00

rate 0.045

PV 223.90

PV c $344.9352

PV m $223.8959

Total $568.8311

Price variation on Faulk

($568.8311 - $704.4897) / $704.4897 = -0,1925629

Yoo Company:

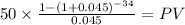

C 50.000

time 34

rate 0.035

PV $985.0342

Maturity 1,000.00

time 34.00

rate 0.035

PV 310.48

PV c $985.0342

PV m $310.4761

Total $1,295.5103

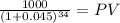

C 50.000

time 34

rate 0.045

PV $862.3379

Maturity 1,000.00

time 34.00

rate 0.045

PV 223.90

PV c $862.3379

PV m $223.8959

Total $1,086.2338

($1,295.5103 - $1,086.2338 ) / $1,295.5103 = 0,1615398