Answer:

$130000

Step-by-step explanation:

Given: Sales revenue= $900000.

Variable cost of goods sold= $440000.

Fixed manufacturing cost= $160000

Variable selling and administration expense= $100000.

Fixed selling and administrative expense= $70000.

Now, finding the income from operation for June.

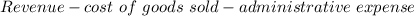

Formula; Income from operation=

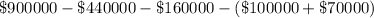

⇒ Income from operation=

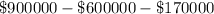

⇒ Income from operation=

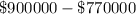

⇒ Income from operation=

∴ Income from operation=

Hence, $130000 is the income from operation for June.