Answer:

NPV = $28020.99

so he accept the this project as NPV value is positive

Step-by-step explanation:

given data

CF 0 = $80000

CF 1 = $40000

CF 2 = $40000

CF 3 = $30000

CF 4 = $30000

discount rate r = 12%

solution

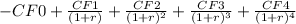

we get here Net present value (NPV) of the project that is total sum of the current value of all flow that is express as

NPV =

...........................1

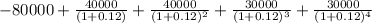

...........................1

put here value and we get

NPV =

solve it we get

NPV = - 80000 + 35714.29 + 31887.76 + 21353.41 + 19065.54

NPV = $28020.99

so he accept the this project as NPV value is positive