Answer:

The 95% CI is (6.93% , 7.47%)

The 99% CI is (6.85% , 7.55%)

Explanation:

We have to estimate two confidence intervals (95% and 99%) for the population mean 30-year fixed mortgage rate.

We know that the population standard deviation is 0.7%.

The sample mean is 7.2%. The sample size is n=26.

The z-score for a 95% CI is z=1.96 and for a 99% CI is z=2.58.

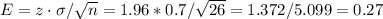

The margin of error for a 95% CI is

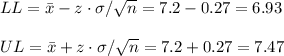

Then, the upper and lower bounds are:

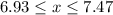

Then, the 95% CI is

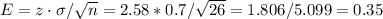

The margin of error for a 99% CI is

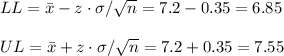

Then, the upper and lower bounds are:

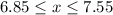

Then, the 99% CI is