Answer:

Using effective -rate:

Cash 35,824,122 debit

Bonds Payable 32,000,000 credit

premium on bonds payable 3,824,122 credit

--to record issuance--

Interest expense 1,970,326.73 debit

premium on BP 109,673.27 debit

cash 2,080,000 credit

--to record first interest payment--

Interest expense 1,976,358.76 debit

premium on BP 103,641.24 debit

interest payable 2,080,000 credit

--to record accrued interest to Dec 31th--

interest expense on first year:

1,970,326.73 + 1,976,358.76 = 3.946.685,49

Using Straight line:

interest expense 1.888.793,9 debit

premium on BP 191.206,1 debit

cash 2,080,000 credit

--to record first interest payment--

interest expense 1.888.793,9 debit

premium on BP 191.206,1 debit

interest payable 2,080,000 credit

--to record accrued interest for the second payment--

total interest expense:

1.888.793,9 + 1.888.793,9 = 3.777.587,8

4) Yes as investor will be willing to purchase at a higher price until get the market yield

5)

PV coupon payment $ 24,856,795.5687

PV maturity $ 10,967,326.8265

Total $ 35,824,122.3952

Step-by-step explanation:

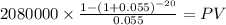

Present value of the bond is the discounted value of the coupon payment and maturity.

C 2,080,000.000

time 20

rate 0.055

PV $24,856,795.5687

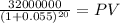

Maturity 32,000,000.00

time 20.00

rate 0.055

PV 10,967,326.83

PV c $24,856,795.5687

PV m $10,967,326.8265

Total $35,824,122.3952

Then we solve for the effective rate doing carrying value times market:

$35,824,122.3952 x 0.055 = 1,970,326.73

And the cash outlay:

32,000,000 x 0.065 = 2,080,000 debit

The difference is the amortization on premium

The striaght-line will distribute the premium over time equally:

3,824,122 / 20 = 191.206,1

this will be subtracted from the cash outlay to determinatethe interest expense.