Answer:

1 years

Step-by-step explanation:

We use the Excel sheet to calculate the economic life the other press.

The data input would be explained as following:

+) Column A: End of year i

+) Column B: The salvage value of the press

Year 0, the salvage value = First cost = $150,000

As each year, the market value would decrease $25,000, so that the savage value of year i= 150,000 - 25,000 * i

=> Column B = 150,000 - 25,000 * Column A

+) Column C is the present worth of salvage value of the press, calculated as below:

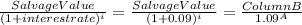

PV Salvage value year i =

+) Column D is the equivalent annual cost (EAC) of capital, can be calculated by the formula:

EAC (Capital) Year i = (First cost - PV Salvage value year i) ×

= (150,000 - Column C) ×

+) Column E is the maintenance and operation cost of the press.

O&M Cost of year 1 is $4,000

As this cost are expected to increase by $5,000 each year, so that since year 2:

O&M Cost Year i = 4,000 + 5,000*(i-1) = 4,000 + 5,000*(Column A-1)

+) Column F is total cost of operation and maintenance, installation and removal of press

=> Column F = Column E + 3,500

The total cost of O&M, I&R in the year 1 = 7500

+) Column G is the EAC of the cost above

EAC in the Year 1 = PV Cost x

=

=

×

×

= 7500

= 7500

Since year 2:

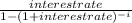

EAC in year i = EAC Year (i -1) + (Total cost Year i - EAC Year i - 1) ×

×

×

+) Column H = EAC Total = D + G

The year with the minimum EAC Total value is the economic life of the press.

As we can see from the excel sheet, the mininum EAC is at the end of year 1

=> Economic life of the press if 1 year