a) cost of equity is 8.4%

b) weighted average cost of capital is 7.19%

c) Net sales is $16,814 or $16,800 (rounded off )

Step-by-step explanation:

a) Calculation of cost of equity

Under Capital Asset Pricing Model

It takes into account the riskiness of an investment relative to the market. The model is less exact due to the estimates made in the calculation

Ke = Rf + βi × [E(Rm) – Rf]

Where:

Ke = cost of capital

Rf = Risk-free rate of return

βi = Beta of asset i

E(Rm) = Expected market return

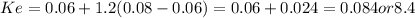

Ke = 6% + 1.2 (8% - 6% )

Ke = 0.06 + 1.2 (0.08 -0.06) = 0.06 + 0.024 =0.084 or 8.4%

b) calculation of weighted average cost of capital

weighted average cost of capital = (VE×Re)+(VD×Rd×(1−Tc))

where:

E=Market value of the firm’s equity

= $20,000,000 (1,000,000 shares ×$20)

D=Market value of the firm’s debt

= $41,000,000 (50,000 bonds × $820)

V=E+D = $61,000,000

Re=Cost of equity = 8.4% (Refer to calculation of ke)

Rd=Cost of debt = 10%

Tc=Corporate tax rate = 34%

V=E+D= $61,000,000

The equity-linked cost of capital

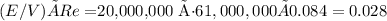

(E/V)×Re= $20,000,000 ÷$61,000,000 × 0.084 = 0.028

The debt component

D/V)×Rd×(1−Tc) =

$41,000,000 ÷$61,000,000 × 0.10 ×(1-0.34) =0.044

weighted average cost of capital

= 0.028 + 0.044 = 0.719 or 7.19%

c) calculation of net sales

Net profit = Dividend = (30% of net income) $1,400 ÷30×100 = $4667

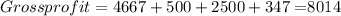

Gross profit = Net profit + Depreciation + selling and administrative expenses + interest

Gross profit = 4667+500+2500+ 347 = $8014

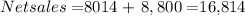

Net sales = Gross profit + cost of good sold

Net sales = $8014 + $8,800 = $16,814

Note :

Tax and dividend has been paid after computing Net income ., so these item does not included for net profit calculation