Answer:

$6150.

Step-by-step explanation:

Given:

Tomko Company purchased machinery with a list price of $96,000.

10% discount by the manufacturer.

They paid $600 for shipping and sales tax of $4,500.

Tomko estimates that the machinery will have a useful life of 10 years and a residual value of $30,000.

If Tomko uses straight-line depreciation, annual depreciation will be ?

Solution:

List price of machinery = $96,000

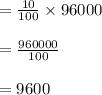

Discount amount = 10% of 96,000

Shipping cost = $600

Sales tax = $4,500

Actual cost of machinery = List price - Discount amount + Shipping cost + Sales tax

Actual cost of machinery = $96000 - $9600 + $600 + $4500

= $91,500

Residual value = $30,000

Useful life = 10 years

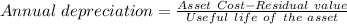

As we know:

Thus, annual depreciation of machinery of Tomko Company will be $6150.