a)Little book LTD earning per share is $1.118 per share.

Step-by-step explanation:

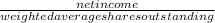

To calculate earning per share we will use following formula:

Now to find net income we will take help of asset turnover ratio :

Asset turnover ratio =

1.5 × $860000 = x

1.5 × $860000 = x

x (net sales) = $1290000

Outstanding shares = 75000 shares

So Net Income = $1290000×.065

= $83850

Now Earning per share =

Earning per share = $1.118

b) Market to Book Ratio will be 1.2 for Little Book LTD.

Step-by-step explanation:

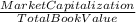

Market to Book Ratio =

Market Capitalization = $ 75000× $ 12

= $900000

So, Market To Book Ratio =

Market To Book Ratio = 1.2