Final answer:

For Option 1, the interest paid is $404.81. For Option 2, the interest paid is $441.57.

Step-by-step explanation:

For Option 1, the interest is compounded quarterly.

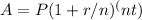

To calculate the interest, we use the formula

where A is the final amount, P is the principal amount, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years.

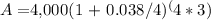

In this case, P = $4,000, r = 3.8% or 0.038, n = 4 (quarterly compounding), and t = 3 years.

Plugging these values into the formula, we get

= $4,404.81.

The interest paid is $4,404.81 - $4,000 = $404.81.

For Option 2, the interest is compounded continuously.

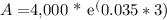

To calculate the interest, we use the formula A = P*e^(rt), where e is Euler's number( approximately 2.71828).

In this case, P = $4,000, r = 3.5% or 0.035, and t = 3 years.

Plugging these values into the formula, we get

= $4,441.57.

The interest paid is $4,441.57 - $4,000 = $441.57.