Given: Cash and Cash Equivalents = $28,000

Short term investments = $88,000

Net Current Receivables = $122,000

Inventory = $64,000

Prepaid Insurance = $14,000

Supplies = $11,000

Total current liabilities = $304,000

To Calculate: Quick Ratio

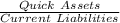

Solution: Quick ratio for a company represents it's ability to pay off it's current liabilities as and when they accrue. The ratio is computed as,

=

Quick assets are those assets which can be quickly convertible into cash within a period of 90 days.

Quick Assets = Cash and cash equivalents + short term investments + current accounts receivables + marketable securities

Thus, Quick Assets = $28000 + 88,000 + 122,000 = $ 238,000

Current Liabilities = $304,000

Thus, Quick Ratio =

= 0.78 approx.

= 0.78 approx.