The last part of Question:

How much money will Todd and Jessalyn have in 45 years if they do nothing for the next 10 years, then puts $2400 per year away for the remaining 35 years?

Answer:

Todd and Jessalyn will still have $346,590.23 in 45 years if they do nothing

Step-by-step explanation:

End of the year deposit, Annuity (A) = $2,400

Interest rate, r = 7.2% = 0.072

Number of years of deposit, n = 35

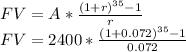

The future value can be calculated given the formula:

FV = 2400 * 144.413

FV = $346,590.23

Todd and Jessalyn will still have $346,590.23 in 45 years if they do nothing. The money they have saved for 35 years will outlive their 10 years of idleness