Answer:

b) long 480 contracts

Step-by-step explanation:

Given:

Worth of equity portfolio = $100m

Dow = 20,000

Portfolio beta = 0.96

Features multiplier, Fm = 10

For number of contracts needed to double portfolio beta, we have:

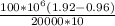

=

= 480

Therefore, the correct number of contracts and position needed to double the portfolio beta is 480 contracts