Answer:

Annual revenues for 18,377,219 dolllar will make the project worthwhile

Step-by-step explanation:

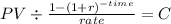

We have to solve for the revenue which yields a return for 22% on the project cashflow investment at time zero:

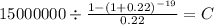

PV 15,000,000.00

time 19

rate 0.22

C $ 3,377,218.685

Now, this 3,377,218.68 will represent the postivie cash flow per year.

As there are 15,000,000 epxenses per year we add it to the calculation to get the revenues per year:

15,000,000 + 3,377,218 = 18,377,219