Answer:

Market value at 8% YTM $ 743.2156

at 10% YTM $ 619.6960

Step-by-step explanation:

Assuming the face value is 1,000 as common outstanding American company's bonds:

Market value under the current scenario:

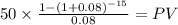

Present value of the coupon payment:

Coupon: $1,000 x 5% = 50

time 15 years

rate 0.08

PV $427.9739

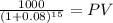

Present Value of the Maturity

Maturity 1,000.00

time 15.00

rate 0.08

PV 315.24

PV c $427.9739

PV m $315.2417

Total $743.2156

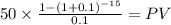

If the interest rate in the market increaseby 2% then investor will only trade the bonds to get a yield 2% higher that is 10% so we recalculate the new price:

C 50.000

time 15

rate 0.1

PV $380.3040

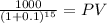

Maturity 1,000.00

time 15.00

rate 0.1

PV 239.39

PV c $380.3040

PV m $239.3920

Total $619.6960

Giving a lower price than before