Answer:

Return on common stockholders' equity=0.0933=9.33 %

Step-by-step explanation:

Net Income=$200,000

Preferred Stockholder Dividends=Number of shares* value per share*interest

Preferred Stockholder Dividends=10000*$100*6%

Preferred Stockholder Dividends=10000*$100*0.06

Preferred Stockholder Dividends=$60,000

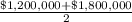

Average Common stockholders' equity= (Equity at start of year+Equity at end of year)/2

Average Common stockholders' equity=

Average Common stockholders' equity=$1,500,000

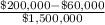

Return on common stockholders' equity=(Net Income-Preferred Stockholder Dividends)/Average Common stockholders' equity

Return on common stockholders' equity=

Return on common stockholders' equity=0.0933=9.33 %