Answer:

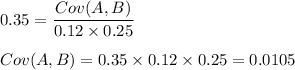

The co-variance between these two securities is 0.0105

Explanation:

We are given the following in the question:

Correlation coefficient = 0.35

Standard deviation of Security A = 12%

Standard deviation of Security B = 25%

We have to find the co-variance between these two securities.

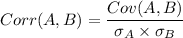

Formula:

Putting values, we get,

Thus, the co-variance between these two securities is 0.0105