Answer:

15.57%

Step-by-step explanation:

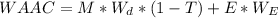

The WAAC (Weighted average cost of capital) is given by:

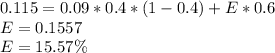

Where M is the rate to maturity of the company's bonds, Wd is the fraction of debt, We is the fraction of equity, T is the tax rate, and E is the rate of cost of common equity. Applying the given data:

The company’s cost of common equity is 15.57%.