Answer:

She will receive $3,494.95 per month.

Step-by-step explanation:

Jennifer's pension plan is an example of a sinking fund.

A sinking fund is an account that earns compound interests and into which periodic payments are also made.

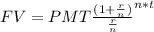

The formula for calculating the future value of payments in a sinking fund account is given as:

where:

FV = Future value

PMT = periodic payment = $300

r = interest rate in decimal = 7% = 0.07

n = compounding period per year = monthly = 12

t = number of years compounded = 40

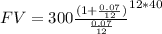

hence:

∴FV = $838,786.8

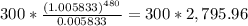

Finally, we are asked to calculate the amount she will be paid per month in a 20-year payout period, and this is shown below:

20 years = 12 months × 20 = 240 months

Therefore, amount to be paid in a 240 month period =

future value ÷ total number of months 838,786.8 ÷ 240 = $3,494.95