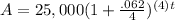

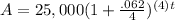

Answer:

Explanation:

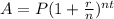

You are going to want to use the compound interest formula, which is shown below.

P = initial balance

r = interest rate

n = number of times compounded annually

t = time

Since the balance is compounded quarterly, the number

will be used for n.

will be used for n.

Now lets plug in the values into the equation: