Answer:

Case 1:

1) The depreciation expense of 2014 is $17,000

2) book value at December 31, 2014 is $56,000

3) Accumulated depreciation is $70,560

Case 2:

The revised annual depreciation of the:

+) building is $30,000

+) warehouse is $10,800

Step-by-step explanation:

CASE 1: Dougan Company

1) Compute the amount of depreciation expense for the year ended December 31, 2014, using the straight-line method of depreciation.

The straight line method of depreciation is the method when the value of the fixed asset declines over its useful life gradually - the annual depreciation expense is the same over years.

The annual depreciation expense is calculated as below:

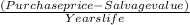

+) Annual depreciation expense =

As the annual depreciation expense is the same over years

=> The depreciation expense of 2014 is $17,000

2. Compute the amount of depreciation expense for the year if 16,000 units of product are produced in 2014 and 24,000 units are produced in 2015 assuming the company uses the units-of-activity depreciation method.

If using the units-of-activity depreciation method, the depreciation expense per unit of activity can be calculated as following:

+) Depreciation expense per unit = (Purchase price - Salvage value)/ (Total units of product)

In 5 years of life, the total units produced are: 100,000

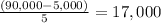

=> Depreciation expense per unit =

per unit

per unit

The depreciation expense of each year can be calculated as following:

+) Depreciation Year X = Depreciation per Unit x Units produced Year X

So that:

+) Depreciation expense 2014 = 0.85 x 16,000 = $13,600

+) Depreciation expense 2016 = 0.85 x 24,000 = $20,400

=> Accumulated depreciation = 13,600 + 20,400 = $34,000

We have: the book value at December 31, 2014 would be:

+) Book value 31/12/2014 = Cost of asset - Accumulated depreciation

= 90,000 - 34,000 = $56,000

3. If the company uses the double-declining-balance method of depreciation, what is the depreciation expense for the first three years (2014 – 2016)?

The asset has the useful life of 5 years, so that its straight-line depreciation rate is:

+) Straight line balance rate = 100%/ (Years of useful life) = 100/5 = 20%

=> Its double-declining depreciation rate = Straight line balance rate x 2 = 20% x 2 = 40%

We have the formula:

Depreciation expense = Book value at the beginning of the year x Depreciation rate

+) The book value at the beginning of 2014 is $90,000

=> Depreciation expense in 2014 = 90,000 x 40% = 36,000

+) The book value at the beginning of 2015 is: 90,000 - 36,000 = $54,000

=> Depreciation expense in 2015 = 54,000 x 40% = 21,600

+) The book value at the beginning of 2016 is: 54,000 - 21,600 = $32,400

=> Depreciation expense in 2016 = 32,400 x 40% = 12,960

=> Accumulated depreciation = ∑Depreciation expense in 2014, 2015, 2016

= 36,000 + 21,600 + 12,960 = $70,560

CASE 2: Frank White

Compute the revised annual depreciation on each asset for the year of 2015.

1. Building

+) Book value of building in 1/1/2015 = Cost of assets - Accumulated depreciation = 1,600,000 - 228,000 = $1,372,000

+) Its salvage value in 1/1/2015 = $52,000

=> The depreciation cost of building = Book value - salvage value

= 1,372,000 - 52,000 = $1,320,000

+) As the proposed useful life of building is 50 years and the depreciation has been charge for 6 years (from 2009 to 2015)

=> The revised useful life of building = 50 - 6 = 44 years

=> The revised annual depreciation = Depreciation cost/ Revised useful life in years

= $1,320,000 / 44 = $30,000

So the revised annual depreciation of the building is $30,000

2. Warehouse

+) Book value of warehouse in 1/1/2015 = Cost of assets - Accumulated depreciation = 207,000 - 40,000 = $167,000

+) Its salvage value in 1/1/2015 = $5,000

=> The depreciation cost = Book value - salvage value

= 167,000 - 5,000 = $162,000

+) the proposed useful life of warehouse is 20 (acquired in 2015) years but the old useful life is 25 years (acquired in 2009)

=> So that the depreciation cost was charged until the years of life of warehouse is 20. (in 2014)

=> So that the depreciation cost was charged in 5 years after 2009 (means from 2009 to 2014) and in 2015, the depreciation cost was not charged as there was no change in the proposed value.

=> The revised useful life of warehouse = 20 - 5 = 15 years

=> The revised annual depreciation = Depreciation cost/ Revised useful life in years

= $162,000/15 = $10,800

So the revised annual depreciation of the warehouse is $10,800