Answer:

The membership cost of rights offering is lower than the market cost of share. It represents that rights offered by the organization are progressively important to the speculators, utilizing which they can buy the new portions of the organization. If they are not intrigued to participate in the rights offering, they can sell their privileges at the honest evaluation.

Coming up next are steps to ascertain the cash that will be gotten by selling the rights:

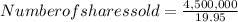

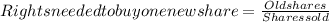

Step 1: Compute the number of shares sold

![Number of shares sold = (Amount needed)/( [Subscription price x (1 - Spread)])](https://img.qammunity.org/2021/formulas/business/college/gzpjsg80kxmq6u1u3rml7muuydr45o6mzm.png)

![Number of shares sold = (4,500,000)/( [21 * (1 - 0.05)])](https://img.qammunity.org/2021/formulas/business/college/gc5trjn63f70gvf6k7cux4f7x79e3vdyam.png)

Number of shares sold = 225,564

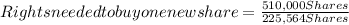

Step 2. Compute the number of shares needed to buy one new share:

Rights needed to buy one new share = 2.26

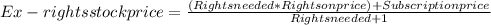

Step 3: Compute the ex-rights stock price:

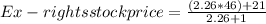

Ex-rights stock price = $38.33

Step 4: Compute the value of one-right

Value of One-Right = Rights on price - Ex-rights price

Value of One-Right = $46 - $38.33

Value of One-Right = $7.67

Step 5: Compute the proceeds from sale of rights:

Sale proceeds = Shares owned x Value of one right

Sale proceeds = 4,000 Shares x $7.67

Sale proceeds = $30,680

Thus, the amount of $30,680 will be received by selling the rights.