Answer:

Explanation:

Amount of money to invest in Atlantic Oil= A

Amount of money to invest in Pacific Oil = P

Total money invested in the two oil companies = A+P

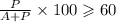

Since at least 60% of the money invested in the two oil companies must be in Pacific Oil

Hence the required model is