Answer:

Step-by-step explanation:

We will first state the equation.

![V(I,R)=1000[(1+0.07(1-R))/(1+I)]^(10)](https://img.qammunity.org/2021/formulas/business/college/9hj821cajrsvhf7fyx705dbzffj20gtp71.png)

Where:

I = annual rate of inflation;

R = the tax rate for the person making the investment.

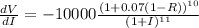

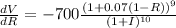

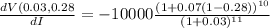

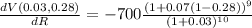

We first determine the partial derivatives with respect to I and R.

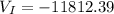

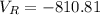

VI(0.03, 0.28)

=-11812.39

=-810.81