Answer:

$3,078.04

Explanation:

-Given her income is $27,267, she falls under the 10% and 12% brackets with the following boundaries as attached.

-Her tax is then calculated as;

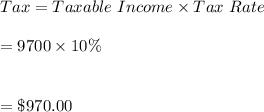

#10% bracket;

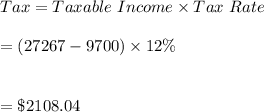

#12% Tax bracket:

The total tax=970+2108.04=$3,078.04

Hence, Lynn owes $3,078.04 in taxes.