Answer:

The bond will be sold at: $96,867.76.

Explanation:

To know the market value of the bond, we need to calculate all the cash flow it is expected from the bond and then discount this cash flow at the market discount rate.

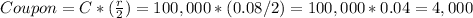

The bond will pay a coupon each semester (as the contract is paid semiannually), of an amount of:

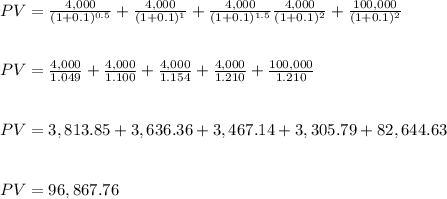

We can calculate the sales price of the bonds discounting the cash flow at the market rate: