Answer:

beta of portfolio is 1.55

Step-by-step explanation:

First we calculate the Equity Risk Premium, given as:

Equity Risk Premium = Market Return - Risk Free Rate

= 11 - 6 = 5%

Given that;

Risk Free Rate = 6%

Return on Stock = 13.75%

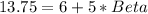

Second, we calculate the Return on Stock

Return on stock = Risk-free rate + Equity risk premium * Beta for stock