Answer:

Indicates how many times the receivables were converted into cash during the year.

Step-by-step explanation:

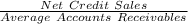

Accounts receivables turnover ratio or Debtor Turnover Ratio(DTR) depicts the number of times a business's receivables are converted into cash within a period.

The ratio is computed as follows:

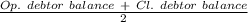

wherein, Average Accounts Receivables =

wherein, Op. = Opening

Cl. = Closing

The ratio depicts how often a firm receives the money due from it's debtors during a period and represents how frequently debtors make payments, represented by average collection period which is computed as follows:

=