Answer:

correct option is c. $2,164

Step-by-step explanation:

given data

Cash Flow C = $25000

expected Interest rate r = 10% = 0.10

Total Periods n = 60 year to 80 year = 20 years

solution

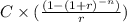

we get here present value of ordinary Annuity that is

present value =

....................1

....................1

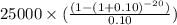

put here value and we get

present value =

solve it we get

present value = 212839.09

so Annuity paid amount by 35 age to 60 age is $212839.09

and

now it will future value for age 35 year to 60 year that is 25 year time period

Future Value = $212839.09

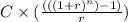

now we apply formula for future value of ordinary Annuity that is

future value =

...................2

...................2

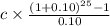

put here value and we get

$212839.09 =

solve it we get

c = $2164.16

so correct option is c. $2,164