Answer:

$841 approx

Step-by-step explanation:

Bonds refer to debt instruments whereby the issuer raises long term finance, agreeing to pay the lenders, a fixed rate of coupon payments at regular intervals and repayment of principal upon maturity.

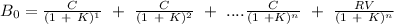

The present value of a bond is represented as:

where

Present value of a bond

Present value of a bond

C = Annual coupon payments

k = yield to maturity/ cost of debt

n = years to maturity

RV = Redemption value

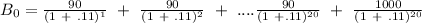

here, C = 1000 × 9% = $90

K = 11%

n = 20 years

RV = $1000

putting these values in the above equation, we have,

= 7.9633 × 90 + 0.124 × 1000

= 7.9633 × 90 + 0.124 × 1000

= 716.699 + 124.033

= 716.699 + 124.033

= $ 840.73 OR $ 841 approx.

= $ 840.73 OR $ 841 approx.

Thus, the bond will sell at $841 today.