Answer:

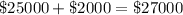

The correct pretax income in 2018 is $27000.

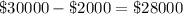

The correct pretax income in 2019 is $28000.

Step-by-step explanation:

In 2018, the reported pretax income was $25000, however, ending inventory was understated by $2000.

The Cost of goods sold was overstated making net income understated.

∴ The correct pretax income for 2018 should be =

.

.

In 2019, the reported pretax income was $30000, which means it is overstated by $2,000.

∴ The correct pretax income for 2019 should be =

∵ The understated ending inventory would become beginning inventory which would cause the cost of goods sold to be understated and net income was overstated.