Answer:

$3150

Step-by-step explanation:

Given:

Cost of the asset purchased = $87500 (on 1st October. 2022)

Salvage value at the end of its useful life = $24500

Useful life estimated = 5 years

Question asked:

What is the depreciation expense for 2022 if Ivanhoe Company uses the straight-line method of depreciation?

Solution:

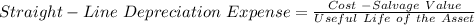

As we know:

Depreciation expenses per year = $12600

But we have to find depreciation expenses for 2022 for:-

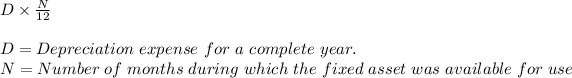

From 1st October, 2022 to 31st December, 2022 = 3 months.

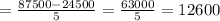

Straight-Line Depreciation Expense for Partial Year =

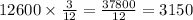

Depreciation Expense for 3 months =

Therefore, the depreciation expense for 2022 if Ivanhoe Company uses the straight-line method of depreciation is $3150.