Answer:

$171,927

Step-by-step explanation:

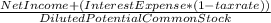

Formula for diluted earnings per share is

Therefore the Numerator will be: Net Income+(Interest Expense *(1 - tax rate))

We have :

Ava's 2018 Net Income: $120,226

Interest Expense: $53,300

Tax rate: 30% or 0.03

So we replace the above values in in Numerator:

Numerator = $120,226 +($53,300(1-0.03))

Numerator = $120,226 + $51,701

Numerator = $171,927

Therefore, the numerator in the diluted earnings per share calculation for 2018 would be: $171,927