Answer:

Price of a bond = $1065.792

Step-by-step explanation:

Given:

- Coupon rate: 8.25% => Coupon payment: 1000*8.25% =82.5 (C)

- YTM = 6.875%

- n = six-year

Price of a bond = PV of Interest payment + PV of RV

- PV of Interest payment : C(1- (1+r)^(-n)/r

<=> 82.5× (1-(1.06875)^(-6))/0.06875 = 394.76

- PV of RV ( Redemption value)

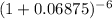

<=> PV of RV = RV ×

<=> PV of RV = 1000 ×

= 671.032

= 671.032

So we have:

Price of a bond = 394.76 + 671.032 = $1065.792