Answer:

See Below

Explanation:

The question is asking:

After how many years, 20,000 will become 500,000 at an annual interest of 11.5%?

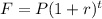

So, we need compound growth formula shown below to solve this:

F is future value

P is present amount

r is rate of interest

t is the time of year

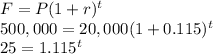

Given,

F = 500,000

P = 20,000

r = 11.5% = 11.5/100 = 0.115

t is what we want to find

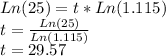

Now, we take natural log of both sides and solve for t:

Its is going to take about 29.57 years, rounding, 30 years