Answer:

NPV = - $5,573.24

Step-by-step explanation:

We know,

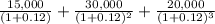

Net Present value = ∑

- Initial Cash flow

- Initial Cash flow

Given,

Cost of capital, r = 12% = 0.12

Initial cash flow = $50,000

number of year, t = 3

Therefore,

Present value of cash flows =

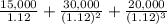

Present value of cash flows =

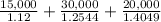

Present value of cash flows =

Present value of cash flows = $13,392.8571 + $23,915.8163 + $14,235.8887

Present value of cash flows = $51,544.56

Present value of cash outflow = $50,000 + [10,000 ÷ (1.12)^3]

Present value of cash outflow = $50,000 + $7,117.80

Present value of cash outflow = $57,117.80

Therefore, NPV = $51,544.56 - $57,117.80

Net present value, NPV = - $5,573.24